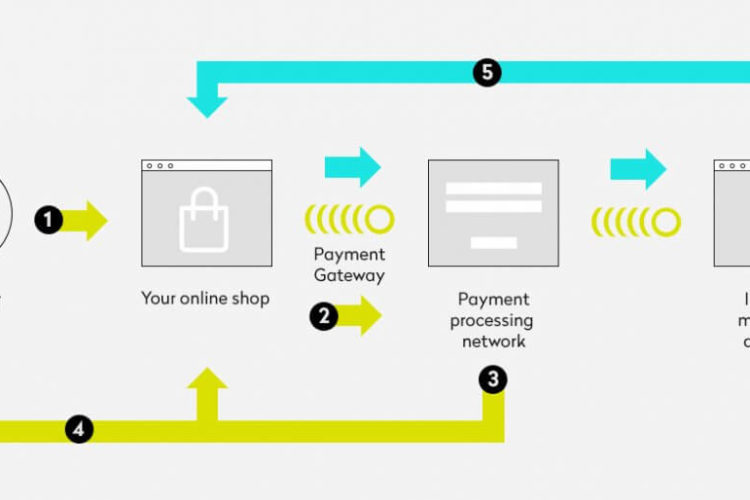

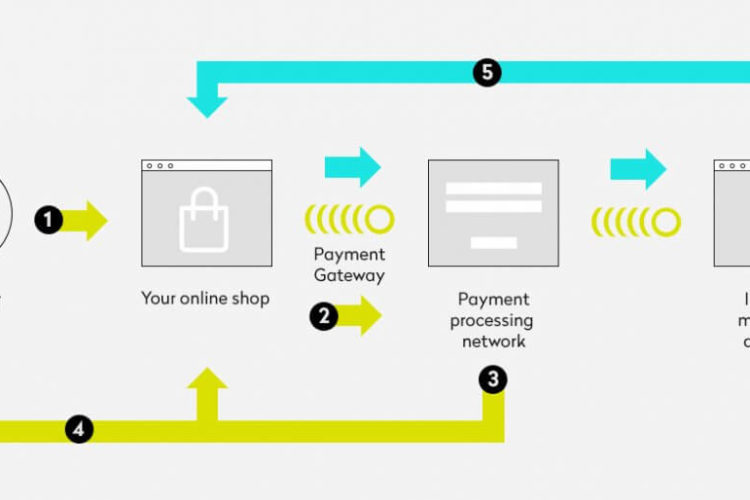

Understanding online payment and its workings is quite a daunting task and one must have a deeper knowledge of online payments to deal with the same. Through this post, we aimed at making the concept of the online payment clear and understood to all the online shoppers. While making online payments, you need three basic components that help process payments online including:

- Bank Account

- Merchant Account

- Payment Processor or Payment Gateway

Bank Account: Bank account will be your account from where you can transfer the amount, spend it, use it, or can keep it as it is in your account.

Merchant Account: You must have details of a merchant account regardless of whether you are processing credit cards online or offline. The majority of the merchant account providers offer one account details to for offline dealings while another account for online, while others may provide a single account for both services.

A merchant account will be offered by an acquiring bank. In the UAE, only three banks are given the authority by the UAE Central Bank to process credit cards. The name of these banks includes Network International, Mashreq Bank, and National Bank of Abu Dhabi.

Payment Gateways in UAE

It means the platform from where the actual payment will be done when a customer uses their credit card online. The service varies from provider to provider, but most of the payment gateways in uae offer different ways allowing a merchant to pay using credit cards and other payment methods.

Payment Gateways Services Include

Hosted Payment Page: It is the easiest way to get up and running, but it comes with limited customization.

API: This option permit you to systemically connect to the gateway and submit the customer’s credit card data for authorization. This method is more flexible and can be customized as well.

Unfortunately, the majority of the merchants ignore the potential PCI (the credit card industry’s rules and regulations) which otherwise is important for them to know. Mostly, a hosted payment page will put a lesser burden whereas a customized way like an API will increase the burden. Many local acquiring banks bundle with a payment gateway so that things can run smoother but it results in poor documentation.

Once you start your venture, taking the services of a third-party payment gateway provider will be an ideal option. They provide their more professional services in addition to or on top of what the local acquiring banks bundle with. Also, you can directly connect to the acquiring bank and will charge a flat fee per transaction rather than a percentage. From hosted payment pages to API access through multiple methods to fraud management, much more are included in the services provided by third-party payment gateway providers.